News

Trade Credit Insurance - Your Key to Growth in a Down Economy

June 13, 2023 •Zuleika Medina-Watkins

Accounts receivable are a critical asset for companies, comprising almost 40 percent of their total assets. Despite their importance, they are also among companies' most vulnerable assets. Unpaid invoices can severely impact a company's cash flow and capital to the point of shutting down its operations. Companies should prioritize managing this risk, especially as inflation continues to affect the cost of everything from household essentials to vehicles.

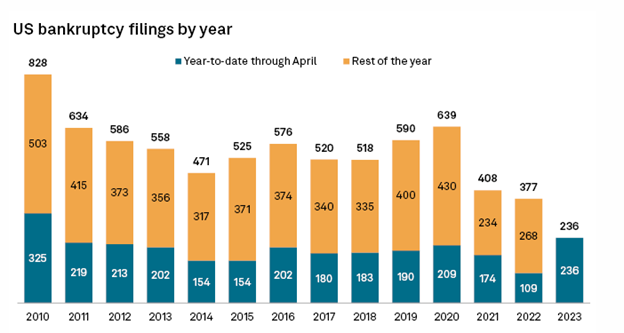

2023 has seen a significant increase in bankruptcy filings, with over 230 companies filing for bankruptcy through April of this year. Seven large companies filed Chapter 11 bankruptcy in less than 48 hours in May. According to Bloomberg, that was the largest number of filings on record during a two-day period since at least 2008.

Source: S&P Global Market Intelligence

Bed Bath and Beyond (BBB) is one the most notable retailers who recently filed for bankruptcy with over $5 billion in debt. Imagine if you had BBB as a customer and you had unpaid invoices. Those invoices would most likely never get paid. How could you have mitigated that risk? One way would have been by having Trade Credit Insurance.

Trade Credit Insurance's protection provides peace of mind knowing that your accounts receivable will be paid because it provides indemnification from customer non-payment and guards against slow payments, ensuring consistent cash flow. Your business can continue to operate normally without being affected by the financial troubles that your customers could be experiencing. However, that is just one benefit of having Trade Credit Insurance. Let's review the other benefits:

Sales Growth

In addition to mitigating bad debt risk, Trade Credit Insurance allows you to expand your business. New customers can pose a challenge because they do not have an established credit history with your company. However, with Trade Credit Insurance, underwriters can provide financial insight to help you decide on whether or not to extend credit terms.

Trade Credit Insurance may also help you expand your business with your existing client base. You may have a customer who requests a higher credit limit or applies for less restrictive credit terms than the usual 30, 60, or 90-day terms of sales. If their receivables are insured, you can be confident in approving an increase in credit or providing extended credit terms. Offering more attractive terms to new and existing customers can enhance your competitiveness, increase sales, and strengthen customer relationships.

Access better financing options

Banks can see accounts receivable as a liability, especially if there are many open invoices with a small number of large customers. This is because if any of these customers default, it can majorly impact your business. However, if accounts receivable are insured, they can be seen as an asset or collateral because the money is secured. It's estimated that banks lend up to 80% more on insured receivables.

Reduction in bad debt reserves

To avoid sudden cash flow interruptions, companies set aside a reserved cash amount if a debt becomes uncollectable. The bad debt reserve is an emergency fund for the business and decreases the amount of working capital available. Small companies cannot afford to have $40,000 or $50,000 tied up in a bad debt reserve as they need the monies readily accessible. Trade credit insurance allows companies to reduce or even eliminate bad debt reserves.

While Trade Credit Insurance protects businesses from problems associated with uncollected commercial debt, its goal is to help companies grow through efficient credit management and asset protection. If you have any questions regarding the benefits of Trade Credit Insurance, contact us.

Featured Articles

Categories

- ATA Carnet (1)

- Business Insurance (9)

- Canada (1)

- Cargo Insurance (16)

- Claims Corner (10)

- Combined Transit Liability (3)

- Compliance (6)

- Contingent Auto Liability (1)

- Contingent Motor Truck Cargo (1)

- COVID-19 (3)

- Customs Bonds (20)

- Cyber Security (10)

- D&O Insurance (3)

- EPLI (3)

- Events (12)

- General Average (7)

- Industry Insights (32)

- Press Release/Company News (15)

- Special Quest (13)

- TIA (6)

- Trade (24)

- Trade Credit Insurance (2)

- Truck Broker Liability (1)

- WESCCON (5)

The Quest Newsletter is designed to provide critical information in the transportation industry. Avalon Risk Management is not responsible for the accuracy or reliability of information contained in articles. The reader/user assumes all risk in the use of such information.