As the number of lawsuits continues to rise against companies, it is crucial for companies to take proactive measures to mitigate their potential risks. One risk involves lawsuits filed against the company and even its directors and officers personally based on a corporate official’s conduct, including breach of fiduciary duty, fraud, discrimination, and other alleged wrongful acts.

Directors and Officers Liability (D&O) Insurance protects directors and officers from legal claims brought against them while performing their duties. It can also provide coverage for legal defense costs and any potential damages resulting from a covered claim.

There is a misconception that if a company is small, private, or family-run, D&O Insurance is not essential. However, companies of all sizes are subject to lawsuits, whether they are public or privately held. Another reason for not buying D&O Insurance is due to not having experienced a D&O related loss in the past. Nevertheless, not having a loss does not guarantee that it will not happen in the future.

According to a Chubb survey, the average reported loss for non-buyers of D&O coverage is $394,000. This amount of money is quite alarming for any business and has the potential to cause significant changes in its financials and even result in closing operations. The Chubb survey also indicates that 26% of private companies experienced a D&O loss in the past three years with an average loss of $387,000. Both statistics highlight the need to obtain proper coverage.

Cyber Risks for Directors and Officers

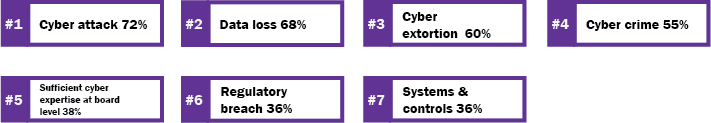

According to the 2023 Global Directors and Officers Liability Survey by WTW, survey respondents listed cyberattacks, data loss and cyber extortion as top risks. In North America, the breakdown for the top 7 risks are:

It is no coincidence that cyber risks are the main concern, considering the number of monthly cyberattacks. Corporate officers not only have to worry about the business repercussions of falling victim to a cyberattack but also the possibility of being sued because of it. As the Allianz Directors and Officers Insurance Insights 2023 report indicates, they are “expected to develop and maintain accountabilities for cyber security before, during, and after any cyber incident… [I]f they do not ensure that proper cyber and information security, incident escalation, and reporting measures are in place, they may be seen to have failed to fulfill their duties.”

To mitigate risks, directors and officers should rely on all available tools, including insurance. One of the tools is a review of the company’s cyber business continuity plan. Creating a business continuity plan is crucial to be prepared in the event of a cyberattack and can help detect any areas of improvement that need to be addressed. We also recommend a yearly review of Cyber and D&O policies to ensure businesses have the appropriate coverage for their company’s exposures. If you would like more information on these coverages, please don’t hesitate to contact us.

.png?height=630&name=Untitled%20design%20(5).png)