Last Friday, June 15, President Trump announced plans for tariffs on $50 billion worth of imports from China. Section 232 tariffs also impose a 25% duty on imported steel and a 10% duty on imported aluminum so what can we expect with additional tariffs on Chinese goods? As trade negotiations escalate, importers must proceed with business and be cognizant about their bottom lines. Additional tariffs will most likely impact import bonds and in turn, importers must be proactive to adhere to Customs Border Protection’s (CBP) requirements to avoid bond insufficiency. It’s important to understand how these increased tariffs will impact import bonds. Should a bond be deemed insufficient by CBP, additional costs and delays can be detrimental to a company.

Last Friday, June 15, President Trump announced plans for tariffs on $50 billion worth of imports from China. Section 232 tariffs also impose a 25% duty on imported steel and a 10% duty on imported aluminum so what can we expect with additional tariffs on Chinese goods? As trade negotiations escalate, importers must proceed with business and be cognizant about their bottom lines. Additional tariffs will most likely impact import bonds and in turn, importers must be proactive to adhere to Customs Border Protection’s (CBP) requirements to avoid bond insufficiency. It’s important to understand how these increased tariffs will impact import bonds. Should a bond be deemed insufficient by CBP, additional costs and delays can be detrimental to a company.

Understand how increased duties will impact import bonds

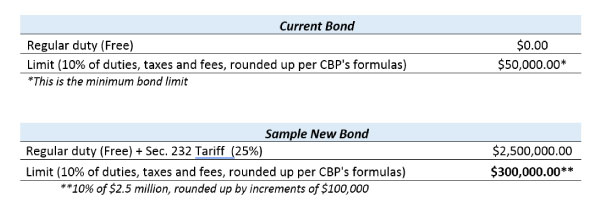

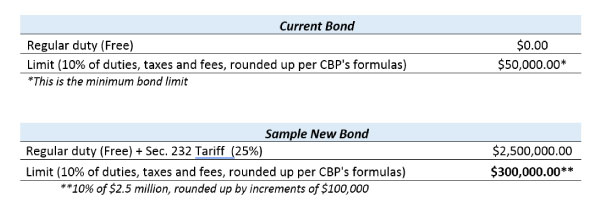

Regular duties and antidumping/countervailing duties are taken into account when calculating the bond limit. Therefore, importers may have to obtain a higher bond amount to comply with the higher tariff rates. The following example shows how the bond limit may need to increase for a company who imports $10,000,000 worth of steel in a 12 month period at a duty free rate per CBP’s Bond Formulas.

With additional tariffs the new bond limits required may be significant. Given that Customs uses the duties, taxes, and fees on a rolling 12-month basis to determine bond sufficiency, you may not need a new bond immediately. However, Customs’ Revenue Division actively reviews the sufficiency of continuous bonds and may send an insufficiency letter requiring an increase. A bond with egregious deficiencies can be rendered insufficient immediately by Customs, which may lead to additional costs and delays for the importing company, since insufficient bonds cannot be used to import.

In addition, Sureties may require additional information, such as financial statements and collateral, on bonds with higher limits or when importing commodities covered by these new tariffs. Additional time may be needed for the filing of the new bond.

Make sure your bond is sufficient

- Allow ample time, reach out to your importing customers of steel and aluminum to determine if their continuous bonds will require increases depending on their plans to continue importing these commodities.

- For those importers that may require increase, start gathering of any underwriting requirements that may be needed, such as a Bond Application and Indemnity, and Financial Statements.

- When applying for a new bond, you are encouraged to consider the duties, taxes and fees anticipated for the next 12 months to avoid a bond insufficiency letter from CBP and potential disruption to your import activity.

- Avalon receives duty information and can send out bond insufficiency emails when applicable on bonds written by Avalon. If you use Avalon’s Merlin software, you can sign up for Bond Sufficiency Email Notifications. You can also use its Bond Sufficiency Calculator to help determine the bond limit that your import clients may need.

Please note that it is the importer’s responsibility to ensure that their bond limit is adequate, and we encourage them to monitor their activity and bond sufficiency closely and proactively. Avalon is here to assist you in helping your import clients manage their bond needs. If you have any concerns about bond sufficiency or the effects of these new tariffs, please contact your Avalon representative to determine bonding needs.

Last Friday, June 15, President Trump announced plans for tariffs on $50 billion worth of imports from China. Section 232 tariffs also impose a 25% duty on imported steel and a 10% duty on imported aluminum so what can we expect with additional tariffs on Chinese goods? As trade negotiations escalate, importers must proceed with business and be cognizant about their bottom lines. Additional tariffs will most likely impact import bonds and in turn, importers must be proactive to adhere to Customs Border Protection’s (CBP) requirements to avoid bond insufficiency. It’s important to understand how these increased tariffs will impact import bonds. Should a bond be deemed insufficient by CBP, additional costs and delays can be detrimental to a company.

Last Friday, June 15, President Trump announced plans for tariffs on $50 billion worth of imports from China. Section 232 tariffs also impose a 25% duty on imported steel and a 10% duty on imported aluminum so what can we expect with additional tariffs on Chinese goods? As trade negotiations escalate, importers must proceed with business and be cognizant about their bottom lines. Additional tariffs will most likely impact import bonds and in turn, importers must be proactive to adhere to Customs Border Protection’s (CBP) requirements to avoid bond insufficiency. It’s important to understand how these increased tariffs will impact import bonds. Should a bond be deemed insufficient by CBP, additional costs and delays can be detrimental to a company.