News

Breaking Down Hired & Non-Owned Auto Liability

February 29, 2024 •Lisa Vranich

Hired and Non-Owned Auto Liability (HNOA) is crucial coverage for any company. It responds to third-party bodily injury and property damage claims filed against your company resulting from an accident caused by a vehicle you HIRED or a vehicle that your company does NOT OWN. This is an exposure that all businesses have if their employees rent cars, hire a rideshare company like Uber or Lyft, or use their own vehicles while conducting company business.

Consider this scenario - your employee rents a car at the airport while on a business trip and gets into an accident when leaving the airport. The accident severely injures another driver and totals that driver's car, resulting in a third-party bodily injury and property damage claim against your company for $350,000. Or imagine if one of your employees takes a client to dinner in their own car and after several rounds of drinks at the bar, they offer to drive the client back to their hotel and get into an accident which leaves the client with devastating injuries. Your employee, acting on your company's behalf, is named in a multi-million-dollar third-party bodily injury suit. While not common, these very serious situations highlight the need for a company to secure Hired & Non-Owned Auto Liability coverage to protect their business.

A common and logical question posed by Freight Brokers is whether their HNOA policy will cover the third-party liability exposure that exists when hiring a Motor Carrier. After all, their entire business model revolves around HIRING Motor Carriers to move freight on trucks that the Freight Broker DOES NOT OWN. The reality is that the intent of most HNOA policies is to cover incidental third-party exposure and conversely, hiring Motor Carriers is the primary focus of a Broker's business. To properly protect themselves, it is essential that Freight Brokers additionally procure a comprehensive Contingent Auto Liability/Freight Broker Liability policy that is written to specifically address the exposure associated with hiring Motor Carriers.

So how does a Freight Broker know if their HNOA Auto policy will or will not respond to third-party claims that stem from hiring a motor carrier? Check your policy for these three clues:

What is your Cost of Hire?

What is your Cost of Hire?

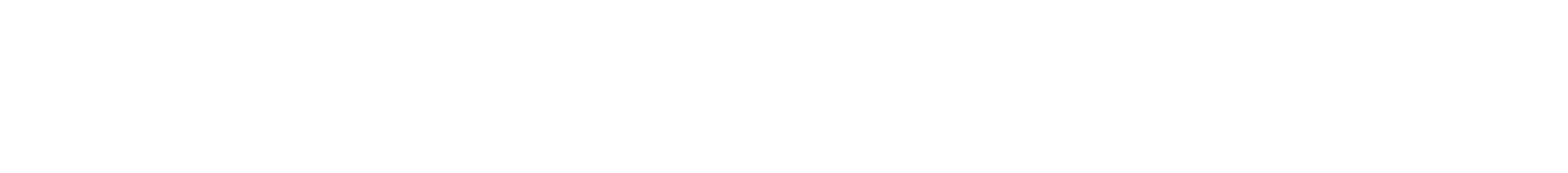

The premium associated with Hired Auto Liability coverage is typically based on a company's annual Cost of Hire, which is the annual amount your business expects to spend on hiring, renting, or leasing vehicles for less than 30 days. If your policy indicates that your “Estimated Cost of Hire” is only a couple thousand dollars (and not the full amount you pay for hiring Motor Carriers annually), that is a good indication that your policy was not written to pick up the Motor Carrier exposure. If your HNOA policy was designed to cover this exposure, why would it be rated on how much you pay annually for your employees to rent cars? One has nothing to do with the other.

If Any?

If Any?

Instead of a dollar amount, your Hired Auto Liability policy may show the phrase “If Any" under the Estimated Cost of Hire. This means that your company’s hiring exposure is very minimal if any exposure exists at all. Again, another clue that your policy is probably not intended to cover the liability you could have for hiring Motor Carriers. To further define “Cost of Hire” (and avoid any confusion), some policies may have verbiage in this section that says "Cost of Hire" does not include charges for services provided by Motor Carriers of property or passengers. Be sure to look for this important coverage clue in the fine print.

Symbol 10

Symbol 10

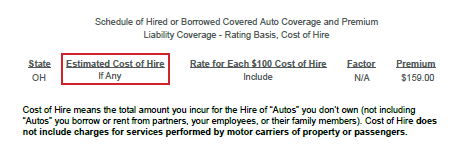

Check your HNOA policy to see what symbols are used. In Auto policies, symbols are used to designate certain types of Auto coverage. Instead of the standard Symbols 8 (for Hired) and 9 (for Non-Owned), some insurance companies may use a custom Symbol 10 so that they can narrow the scope of coverage that is intended by the Auto Liability policy. Look for the section of your policy that contains the Description of Covered Auto Designation Symbols. The description of modified symbol 10 may indicate that Hired or Non-Owned Auto coverage only extends to passenger vehicles or light trucks and doesn’t include vehicles used to transport goods of others, which would preclude any exposure of hiring a Motor Carrier.

Protecting your company from third-party bodily injury and property damage claims is important. It is equally important to ensure that you have the appropriate policies in place for your specific business activity to minimize your exposure and eliminate surprises.

Take the time to break down your policies to safeguard your business from claims that could break your bank.

Contact Avalon today if you would like to review your HNOA and Contingent Auto Liability coverages.

Featured Articles

Categories

- ATA Carnet (1)

- Business Insurance (9)

- Canada (1)

- Cargo Insurance (14)

- Claims Corner (9)

- Combined Transit Liability (3)

- Compliance (3)

- Contingent Auto Liability (1)

- Contingent Motor Truck Cargo (1)

- COVID-19 (3)

- Customs Bonds (14)

- Cyber Security (10)

- D&O Insurance (3)

- EPLI (3)

- Events (10)

- General Average (6)

- Industry Insights (23)

- Press Release/Company News (11)

- Special Quest (8)

- TIA (2)

- Trade (21)

- Trade Credit Insurance (2)

- Truck Broker Liability (1)

- WESCCON (3)

The Quest Newsletter is designed to provide critical information in the transportation industry. Avalon Risk Management is not responsible for the accuracy or reliability of information contained in articles. The reader/user assumes all risk in the use of such information.