News

Tariffs on Steel and Aluminum

March 19, 2018 •Avalon

On March 8, 2018, President Trump signed a Presidential Proclamation on Adjusting Imports of Steel into the United States and a Presidential Proclamation on Adjusting Imports of Aluminum. These will levy Section 232 tariffs on imported steel and aluminum. A tariff of 25% on imported steel and 10% on imported aluminum will be added on top of any other applicable duties, fees, exactions, and charges. Goods entered or withdrawn from warehouse for consumption on March 23 and onwards will face these new tariffs. New harmonized tariff records have been added to accommodate these changes. Canada and Mexico are exempt from these new tariffs. In addition, today’s Federal Register outlines the requirements for submissions of exclusion requests and the filing of objections to submitted exclusion requests.

How will this impact import bonds?

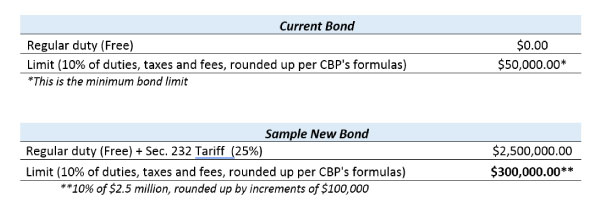

Regular duties and antidumping/countervailing duties are taken into account when calculating the bond limit. Therefore, importers may have to obtain a higher bond amount to comply with the higher tariff rates. The following example shows how the bond limit may need to increase for a company who imports $10,000,000 worth of steel in a 12 month period at a duty free rate per CBP’s Bond Formulas.

With this tariff, the new bond limits required may be significant. Given that Customs uses the duties, taxes, and fees on a rolling 12-month basis to determine bond sufficiency, you may not need a new bond immediately. However, Customs’ Revenue Division actively reviews the sufficiency of continuous bonds and may send an insufficiency letter requiring an increase. A bond with egregious deficiencies can be rendered insufficient immediately by Customs, which may lead to additional costs and delays for the importing company, since insufficient bonds cannot be used to import.

In addition, Sureties may require additional information, such as financial statements and collateral, on bonds with higher limits or when importing commodities covered by these new tariffs. Additional time may be needed for the filing of the new bond.

What can you do to prepare?

- Companies who may have orders of steel or aluminum already in place and these shipments will not be entered until March 23rd or after, will be faced with a significant additional cost which they may not have planned for. It will be important to remind them of this additional cost as soon as possible to ensure funds will be readily available for payment to CBP.

- To allow ample time, you may want to reach out to your importing customers of steel and aluminum to determine if their continuous bonds will require increases depending on their plans to continue importing these commodities.

- For those importers that may require increase, start gathering of any underwriting requirements that may be needed, such as a Bond Application and Indemnity and Financial Statements.

- When applying for a new bond, you are encouraged to consider the duties, taxes and fees anticipated for the next 12 months to avoid a bond insufficiency letter from CBP and potential disruption to your import activity.

- Avalon receives duty information and can send out bond insufficiency emails when applicable on bonds written by Avalon. If you use Avalon’s Web Merlin™ software, you can sign up for Bond Sufficiency Email Notifications. You can also use its Bond Sufficiency Calculator to help determine the bond limit that your import clients may need.

Please note that it is the importer’s responsibility to ensure that their bond limit is adequate, and we encourage them to monitor their activity and bond sufficiency closely and proactively. Avalon is here to assist you in helping your import clients manage their bond needs. If you have any concerns about bond sufficiency or the effects of these new tariffs, please contact your Avalon representative to determine bonding needs.

Featured Articles

Categories

- ATA Carnet (1)

- Business Insurance (9)

- Canada (1)

- Cargo Insurance (15)

- Claims Corner (10)

- Combined Transit Liability (3)

- Compliance (4)

- Contingent Auto Liability (1)

- Contingent Motor Truck Cargo (1)

- COVID-19 (3)

- Customs Bonds (20)

- Cyber Security (10)

- D&O Insurance (3)

- EPLI (3)

- Events (12)

- General Average (7)

- Industry Insights (30)

- Press Release/Company News (14)

- Special Quest (12)

- TIA (6)

- Trade (22)

- Trade Credit Insurance (2)

- Truck Broker Liability (1)

- WESCCON (5)

The Quest Newsletter is designed to provide critical information in the transportation industry. Avalon Risk Management is not responsible for the accuracy or reliability of information contained in articles. The reader/user assumes all risk in the use of such information.